Roof replacement projects aren’t cheap and often run in thousands of dollars. Paying the entire cost of the roof replacement project out of pocket isn’t an option for many homeowners.

Thankfully, there are many finance options available, which is the common route preferred by homeowners to finance their roof replacement projects.

While there are many financing options available, which one you choose depends on your current financial standing, how urgently the roof needs to be replaced, your budget, and your preferences.

Let us delve deeper into the various financial options you can explore before signing the dotted line!

Credit Card

If you need money urgently for a roof replacement project and have stellar credit scores, you might want to avail a new credit card with 0% APR for a promotional period of 12 to 18 months.

However, make sure to pay off the balance in the stipulated promotional period to avoid hefty interest. Also, ask the roofers about the transaction fees they’ll levy when paying through the credit card.

Personal Loan

This is another option like a credit card where there won’t be a lien placed on your home, and in most cases, it can be availed within a week.

You can avail of a personal loan with APR ranging from 6% to 36%, depending on your credit score, and the loan amount can be as little as $1,000 or as high as $100,000 or more.

You need to check with the personal loan provider to see how much APR and loan amount you qualify for.

Home Equity Loan

It is a good financing option if you want to upgrade to a higher-quality material or are looking to go for an expensive roof replacement option.

This is because it offers the security of a fixed term and rate for as long as 30 years, ensuring you pay the lowest amount possible.

You can avail of a home equity loan in lieu of the equity that has accumulated without you having replaced your existing mortgage. Do remember that if you default on its payment, you run the risk of losing your house.

HELOC or Home Equity Line of Credit

This credit line works like a credit card but is secured by your home. The home equity can be converted to cash, and only the remaining balance needs to be paid.

Various credit unions and banks offer HELOCs that can be closed in just a few weeks, making it a worthy financing option if you want to go for roof replacement without waiting for long. The HELOCs have notably lower interest rates than credit cards and personal loans, but a lien is placed on your home, so you can’t risk defaulting on the payment.

Cash-Out Refinance

In this option, you pay off your mortgage with a higher loan amount, and the difference that remains is used to finance roof replacement. These loans are easy to qualify for and have possibly the lowest monthly payment compared to other financing options. Do note, though, that this option takes a long time to get the refinance approved and disbursed.

Roof Contractor Financing

Many roofing contractors offer financing options to the clients depending on their credit score and history to pay for the roof replacement partially or fully.

Some roofers may also offer zero-financing deals with no payment or interest charges for the first six months. The approval is fast, and if you get a good deal, it’s worth its salt as you don’t have to pay credit card transaction fees.

Insurance Coverage

In some cases, homeowner’s insurance will cover the cost of roof replacement if it’s damaged due to storms or hail, and it’s mentioned in the policy coverage. Make sure to purchase comprehensive homeowner’s insurance to protect yourself from such financial expenses later on.

Final Thoughts

There are various ways you can finance your roof replacement project, but the best way is to do due diligence and research on all the available options.

Compare the interest rates, monthly payments, and other variables to ensure they align with your income and current financial standing so that no financial friction occurs afterward.

The idea is to get the best possible roof replacement done without it becoming a financial burden you regret later or which impacts your quality of life.

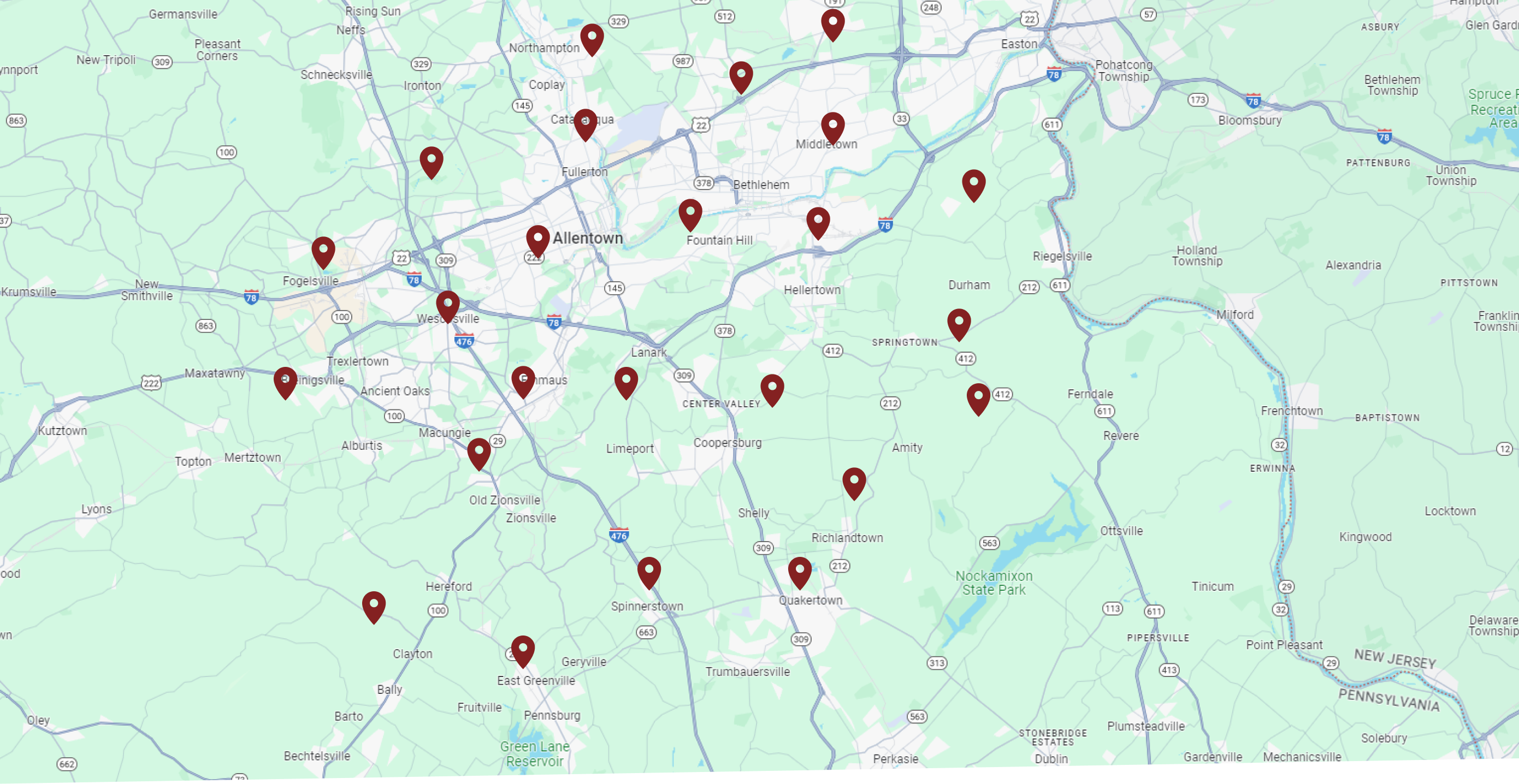

If you need help navigating through the various roof replacement financing options, consult with our experts at Stormtrooper Roofing to guide you in the right direction.